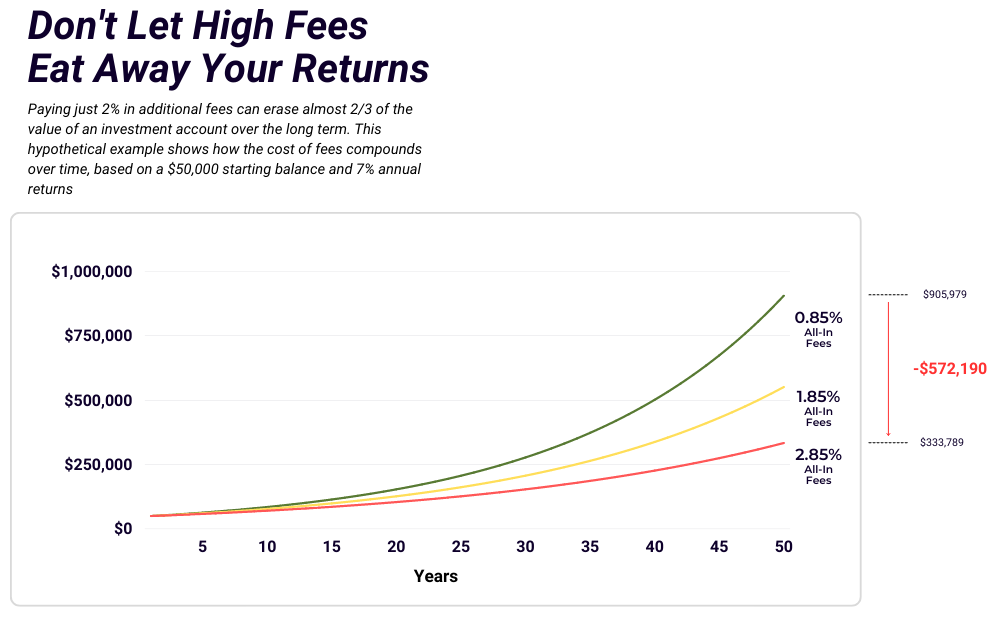

This is a hypothetical example only – it assumes a starting balance of $50,000, 7% annual returns, and fees charged on the ending balance each year.

When considering investment costs, a 1% difference may not seem like much – but those costs compound over time. It’s not just the direct cost of fees paid (which is significant on its own), but also all of the potential future growth of that money if it had been invested. Additionally, studies have shown that funds with higher fees actually underperform when compared to those who charge lower fees.

Outsourced Investment Manager Fees – many firms (due to lack of capacity or experience) outsource the actual investment management to third-party firms, who then charge an additional fee.

We leverage our extensive professional investment experience to directly manage all investments in-house, mitigating this excess cost entirely.

Fund & Security Fees – Active ETFs and Mutual funds have their own management fees charged on any money invested – you can expect these funds to tack on an additional 0.6% fee on average.

At Forrest Financial Partners, we minimize these costs by using extremely low-cost ETFs, or by owning stocks and bonds directly.

Sales Charges & Commissions – Financial Advisors (particularly non-fiduciaries) are allowed to receive commissions or sales charges for mutual funds that they invest your money in – an obvious conflict of interest. These one-time costs can be up to a maximum of 8.5%!

At Forrest Financial Partners there are never any additional commissions or sales charges, reducing costs and potential conflicts of interest.

See our simple, transparent fees here.

1 Based on the $0-$250k AUM tier; source: https://www.kitces.com/blog/independent-financial-advisor-fees-comparison-typical-aum-wealth-management-fee/